Abstracting from the shortages created due to the Russia-Ukraine war, there are three key developments happening in the Indian energy sector. These are policies on hydrogen, on the role of market linked trade in power, and finally the changing coal dynamics. We examine each, in turn.

Present Status

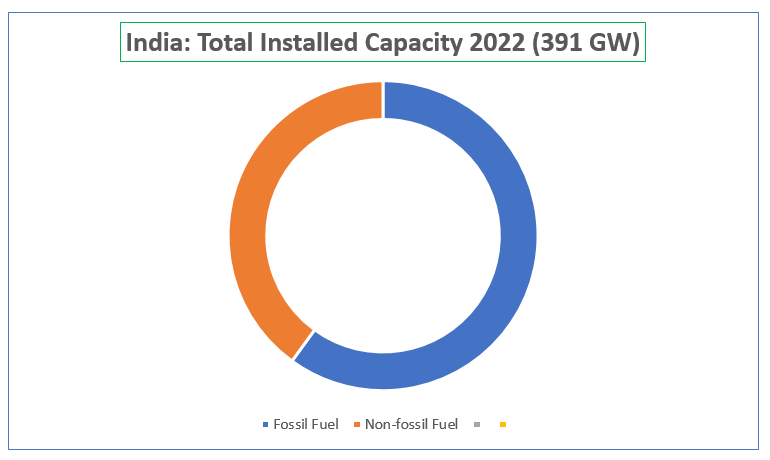

| Non-fossil Fuel Source | Capacity | |

| Solar | 51 GW | |

| Wind | 50 GW | |

| Bio-power | 11 GW | |

| Small Hydro Power | 5 GW | |

| Large Hydro Power | 46 GW | |

| By 2030 | 500 GW Installed Capacity |

Hydrogen:

The hydrogen market being created in India is setting up a string of suppliers, with most energy companies lining up impressive plans. But for power minister R K Singh, the difficult task will be to generate the demand for the fuel to create another alternative market to oil, gas and coal.

The green hydrogen policy announced by the power ministry in March makes a compelling case for manufacturers such as IOC, RIL and others to expand the level of production. Most energy companies have announced massive targets to ramp up hydrogen production. The policy has removed interstate charges for renewable electricity (RE) needed to produce green hydrogen. The waiver will be applicable for all projects set up before 2025 and run for 25 years. Other benefits include land for manufacturers of green hydrogen to set up bunkers near ports for storage for export.

A small note in this context is necessary here. While hydrogen is the product of several chemical reactions of natural gas and coal, since those also release carbon dioxide, the hydrogen is termed grey. Green hydrogen is the result of electrolysis of water, provided the source of electricity is renewable energy. India has also toyed with the intermediate blue hydrogen, where natural gas reacts with steam, aiming to capture the carbon dioxide and methane, but so far, the cost economics are not favourable.

The green hydrogens policy, according to an IOC estimate, could cut costs by up to 50 per cent from the current average of Rs 500 per kg. But experts reckon that for hydrogen to be competitive as a fuel with alternatives such as solar or oil and gas, it needs to be available at less than Rs 100 per kg.

A small note in this context is necessary here. While hydrogen is the product of several chemical reactions of natural gas and coal, since those also release carbon dioxide, the hydrogen is termed grey. Green hydrogen is the result of electrolysis of water, provided the source of electricity is renewable energy. India has also toyed with the intermediate blue hydrogen, where natural gas reacts with steam, aiming to capture the carbon dioxide and methane, but so far, the cost economics are not favourable.

The green hydrogens policy, according to an IOC estimate, could cut costs by up to 50 per cent from the current average of Rs 500 per kg. But experts reckon that for hydrogen to be competitive as a fuel with alternatives such as solar or oil and gas, it needs to be available at less than Rs 100 per kg.

The next stage in cost reduction will, therefore, depend on what the government can do to spur industry and transport sectors to adopt the use of hydrogen in a big way. Only then will large-scale investments flow into the sector. For this to happen, the power ministry must prod a clutch of other ministries to generate demand — steel, shipping, heavy industries, civil aviation and, most significantly, road transport and highways.

All these sectors are potential users of hydrogen. There is also no inherent contradiction between chasing RE targets like solar and also making space for hydrogen in the twilight of the fossil fuel era.

Compared to solar, hydrogen is not energy-efficient for running light vehicles. It can be, however, economical for trucks and ships. And it is a far better fuel for the steel, fertiliser and cement industries than other RE sources. An S&P Platts report predicts that by 2030 hydrogen demand for industry and power generation will make up, respectively, 43.8 and 24.5 per cent of annual fuel consumption.

Despite these advantages, for any government in any major economy, creating the enthusiasm for such a large-scale shift is a formidable task. This is the task the second part of the hydrogen policy needs to fulfil.

Role of Markets: Even a few years ago, the India government would depend on a less difficult route. It would create a market maker, usually a state run entity to generate demand or meet a supply deficiency in any market. In the case of solar and wind renewable energy, this role is being played by Solar Energy Corporation of India.

Given the scale of the shift the government’s plans are remarkable. India plans to generate about 5 million tonnes of green hydrogen by 2030, while a Frost & Sullivan report forecasts global production at almost the same level of 5.7 million tonnes. There is no role envisaged for a market maker either on the demand or supply side. Frost & Sullivan estimates the global compounded annual growth rate must be 57 per cent for this decade, to reach the target.

Instead, the Centre is relying on a carrot and stick policy to drive demand. Last year, for the first time, the ministry for new and renewable energy ticked off states for slipping up on their Renewable Purchase Obligations (RPO). Every state has committed itself to a declaration of trajectory for RPOs up to the year 2022. These commitments add up to India’s declarations on climate change.

When states need to stick to their RPOs they prod user industries to buy their fuel obligations from green sources. A commentator for the sector, Nikesh Sinha, managing director of 8.28 Energy Pte Ltd, an RE company based in Singapore, said India’s hydrogen policy as of now is a bare bones policy. “Companies using this fuel will be encouraged if there’s an RPO to fulfil”.

The hydrogen policy has taken steps in this direction. It states “the benefit of RPO will be granted (as) incentive to the hydrogen/ammonia manufacturer and the distribution licensee for consumption of renewable power”. (Note: ammonia is a chemical compound of hydrogen with nitrogen. It is far more safe and so easy to store and transport than hydrogen which vaporises fast from any container making it very hazardous)

The problem is that some states have begun to baulk at these commitments. Telangana state government created a controversy in March when it sort of accused the centre of forcing it to buy RPOs from “specific developers”. It is a charge the centre has rebutted. While the charges have a political element, but their flare-up does show the limits for the Centre to push the RPO mechanism.

An alternative to hasten the transition could be the role of energy exchange. The market for green energy at both the Indian Energy Exchange and the smaller PXIL has already received the regulatory approvals. The current volumes are puny, but for companies selling renewable electricity, it is the best route to cut prices further. This is because the state-run electricity distribution companies are unable to offer more long-term power purchase agreements to buy electricity. It is only the spot markets where demand can rise for suppliers to be incentivised to bring more RE power to the market. Cheaper RE derived from market mechanics could, thus, lower the cost of producing hydrogen instead of having to depend on government sops

Coal Dynamics: To assess how the transition in the coal economies will pan out, a vital necessity is getting a sense of the timelines. The transition can happen due to one or a combination of several reasons like dwindling coal reserves, or those becoming less profitable as their quality dip, or economies ramping up the capacity for alternatives. Essentially the timeline is an important metric. In this context, how would India’s transition timeline play out?

In the eleven years since FY11, data for the Indian economy shows domestic coal production has lagged consumption, in each of the years. The gap included non-coking varieties too, India’s nomenclature for thermal coal. India has more than adequate reserves of this grade yet there was a gap between demand and supply.

The reasons are several. Of them the chief is the nature of production arrangements. 88.6 percent of Indian coal is still produced by the two government run coal producing companies, Coal India Ltd (CIL) and Singareni Collieries Company Ltd (SCCL). This has been so for fifty years since 1973 when coal mining was nationalised. Till commercial coal mining was finally allowed in 2020 , the efforts to expand coal production by bringing in the private sector had not succeeded in breaking this iron grip.

As a result, the investments necessary to expand coal production were concentrated either with CIL or SCCL. In the absence of support from the state to expand the scope of coal mining for the private sector, foreign companies were not willing to undertake the risk of mining coal, to become mine development operators either under CIL or for the few captive mines in the private sector. For the same reasons, large investments from domestic companies were also not available.

This stymied the pace of additional production over the years. The compounded annual growth rate of domestic production is now just 3.6 per cent since FY11. In fact, the rate is slower in the second half of the past decade (FY15-FY20), at 3.08 percent.

Production statistics for the private sector are, meanwhile, equally soft. For instance, even in FY22 (as on 8th March), the private coal mines have achieved only 73 percent of their annual target. This shortfall is, despite, the sharp rise in demand for coal, experienced this year. In aggregate, then, the gap between the demand and domestic supply of coal has expanded. The gap has led to larger percentage of downstream companies, that use coal as a fuel, to opt for substitutes.

To put an end to the shortages, the government had announced plans to reach an annual target of one billion tonnes of domestic coal production, by FY25. Yet going by current production trends, this seems a long haul. In March this year, aggregate production was 703.06 million tonnes (MT), even now far below the highest production reached by the economy in FY20, at 730.87 MT.

To reach a billion tonnes from here, India will need an improvement in CAGR of 8.18 per cent. An International Energy Agency estimate puts the necessary growth rate at 6 percent. In absolute terms, it implies an increase of 163 MT. Either way, both rates seem far too ambitious.

Instead at the current rate, for domestic coal production to reach 800 million tonnes, will take India to the end of FY24. A coal ministry response to Parliament acknowledges “to meet the rise in demand, CIL has to ramp up the production from Oct 2021 onward”. A Niti Aayog model estimates that the domestic supply of coal shall peak at 1.4 BT by the year 2040, including about 300 MT from the commercial coal mines. Imports shall supply the remaining 200 MT India will need, mostly coking coal. CIL and SCCL production shall peak out at 1.05 BT or 1.1 BT much earlier, mostly 2030. So, the incremental coal will only come from commercial private sector miners.

Amendment of CMSP Act and the MMDR Acts https://pib.gov.in/PressReleseDetail.aspx?PRID=1685058

It is important to discount the current rate of production from CIL and SCCL. This sharp rise to over 2 MT per day is difficult to sustain, due to the following reasons. The biggest of those is that the growth rate of the Indian economy, is expected to average 7.4 percent per annum, till the year FY25. Essentially the size of the Indian economy shall be smaller than the trend value till FY24. For instance, in FY23, it will be 10.2 percent lower than if there had been no interruption due to Covid. A continued weakness in private consumption and investment demand is estimated to contribute 43.4% and 21.0%, respectively, to this shortfall . The Niti Aayog estimate of coal growth was based on a higher rate of growth of the economy. The lower rate will correspondingly dampen the demand from the coal mines.

The other is the trend in mining of coal. The productivity of mining coal has not risen significantly. Output per man shift has slipped from a peak of 9.64 achieved in FY20. Remember, for CIL, salary and wages account for close to 60 percent of the total costs

The final reason is that what the industry needs is not available under the Indian soil. Due to ‘drift origin”, Indian coal resources mostly consist of poor quality non-coking with even coking coal containing high inherent ash. Even this coking coal is in short supply. Almost all the incremental coal demand is from downstream steel industry, which needs coking coal. India plans to triple its annual production of steel from the current 100 million tonnes. Demand for non-coking coal, chiefly led by the power sector has hardly risen. In six years from FY15 to FY21 the compounded annual growth rate for off take of domestic non-coking coal is just 3.06 per cent. Of the 22 coal mines CIL plans to open in the next few years, only one is a coking coal mine. While the coal ministry expects the production from the private mines to double from the current 68 MT by next year, this will depend on whether the mines get all the necessary approvals including land usage and railway connectivity, through. The Niti Aayog estimate too does not expect the total to reach 200 MT before 2030. Each year’s delay makes the odds against, higher.

Yet as CIL and SCCL tries to substitute for the low grade coal with better output they shall mechanise mine operations, even more. This will also raise the price of domestic coal, one of the lowest in the world. Paradoxically, the higher price will reduce the

attractiveness of domestic coal bringing their prices closer to international prices. It is these combination of circumstances that would impede the pace of growth of coal production to make it reach its peak, sooner at a lower altitude.

The plateauing of the domestic supply, has significant implications for downstream industry. The current jump in gas prices, notwithstanding, the government expects large segment of them to switch over. The other entrant is of course hydrogen, which we have discussed above.

All of these investments shall have a long lead time. The user industries have already begun to make the consequential decisions. As more of those get made, retracing to the coal pathway shall become more difficult. Some of the trends are already visible in the financial statements, about which we shall have more to discuss, in future. In sum, the decade and more of shortage in coal has become hardwired in the investment plans of the downstream industries. The tepid pace of investments into new coal capacity, is a reflection of that trend.

Conclusion: How these three strands will play out, will have a significant bearing on India’s quest for energy security. In this piece we have abstracted from the immediate risks and looked at the issues, medium term. The contours of each and more, like developments in the RE sector, we shall examine later.