On almost every street corner in India, we come across small rectangular boards, mounted on what appear to be typical homes in a residential area. Beneath these boards, that proudly bear names of the owners and their posterity (someone & sons), stands a table or a desk manned by a single person. These are India’s Kirana stores or mom and pop shops that stock daily essentials and commodities ranging from rice packets to toothbrushes, from soaps to cooking utensils. Most of them are run by families and do not employ more than two or three workers. Despite the unassuming size of the individual Kirana store, when we put together more than 13 million of them littered across towns and villages of India, they account for a billion-dollar economy that contributes 11% to India’s GDP and employs 8% of the workforce[1]. Simultaneously, the rise of the e-commerce sector in India, has delivered convenience and affordability to consumers on an unparalleled scale. India has the third-largest online shopper base globally, with 14 crore e-retail shoppers in 2020, second only to China and the US, even though currently the penetration of e-commerce in retail is just 5-7%. This number is expected to grow significantly with the addition of 37 crore Generation-Z consumers by 2030, with increasing internet penetration as well as access to smartphones, digital media, and digital consumption platforms.[2] However, there is a risk that the benefits of this expansion will be cornered by the duopoly of Flipkart (owned by Walmart) and Amazon, which together account for more than 60% of the Indian e-commerce retail market.[3]

The Open Network for Digital Commerce (ONDC) launched by the Government of India seeks to head off this trend by developing a network based on open protocols and interoperability. It allows sellers, buyers, and other stakeholders in the value chain, to transact with each other irrespective of the e-commerce platforms on which they are present.

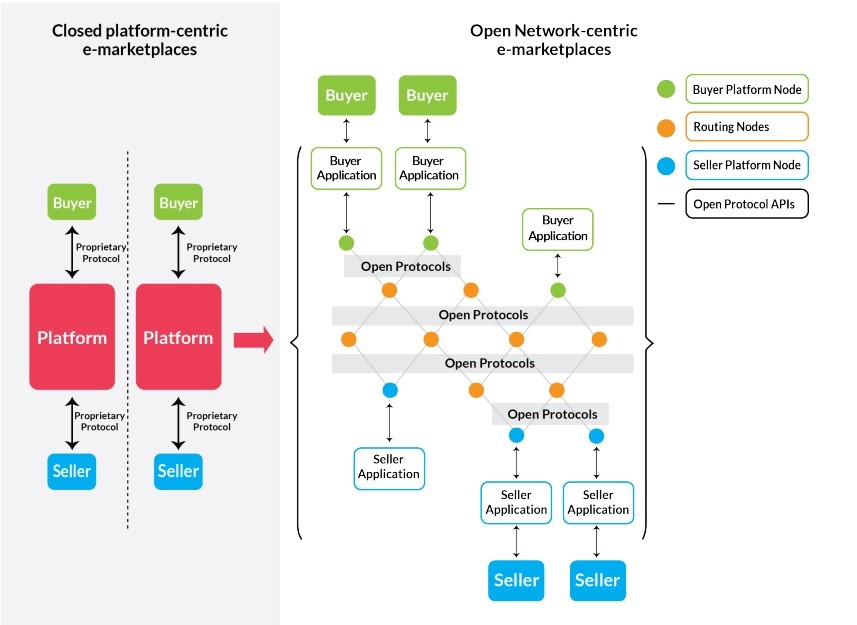

ONDC aims to move e-commerce from a platform-centric model to an open-network. It enables, buyers and sellers to be digitally visible and transact through an open network, regardless on the e-commerce platform they are listed on and is based on three foundational pillars[1]

Listing on ONDC will be based on several parameters including, what the consumer wants, price, location of the seller or the delivery time. It will not be algorithm or commission oriented. The question is, how will this “democratization” of digital commerce benefit our local Kirana store?

DEMOCRATISING DIGITAL COMMERCE

The digital commerce sector has been dominated by platforms such as Amazon and Flipkart, mainly due to the benefits that accrue due to “network effects”, which mean that the value of services offered by these platforms increases as the number of users increases. This simply means that as more and more buyers and sellers are onboarded onto Flipkart and Amazon, all stakeholders will find it more profitable to sell through these platforms. However, these marketplaces are essentially closed-door platforms, which are “stores” or “keepers” of value, which do not permit interoperability. What that means is that the buyer and seller are restricted in visibility to one platform alone. They are also tied to the individual rules and regulations set by the platform (privately owned) and exiting a platform means that one loses all value that has been built through it.

ONDC with its open network platform agnostic approach seeks to level the playing field. In concrete terms, this means that the individual buyer and seller will get visibility across all platforms. For the small Kirana store, this means leveraging digital commerce to connect to a much larger number of consumers. The buyer, seller and enablers (for eg. logistics providers) no longer need to be on the same app or platform for transactions.

This also addresses some of the anti-competitive practices that larger players in the e-commerce have been accused of, such as promotion of the platform’s own private brand labels at the expense of other sellers, predatory pricing, misappropriation of consumer data for better placement of their own private labels and exclusive agreements. The decentralised structure of ONDC reduces the dependence of buyers and sellers on any one platform. It also provides MSMEs with new data points for better price discovery and product design through interaction with a wide consumer base.

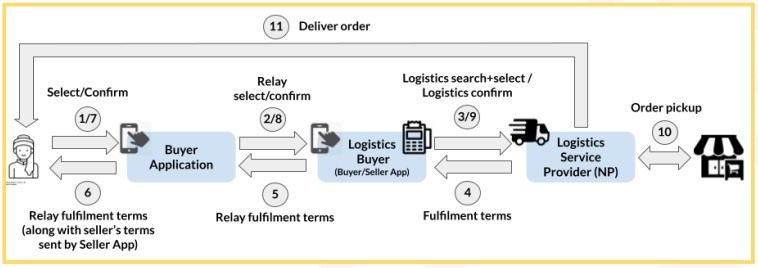

An additional advantage for MSMEs and hyperlocal sellers is access to a wide network of “enablers” across the value chain such as logistics providers, who are also part of the ONDC network. A logistics company would connect with the seller through the network and take the responsibility of delivery. For example, a company like Dunzo or Delhivery, specialising in delivery services, would connect with small sellers, including grocery stores or local Farmers and Producers Organisations (FPOs) and deliver their goods to the end consumer, with all parties being connected via the ONDC Network.

[6] “Building Trust in the ONDC Network” – ONDC Consultation Paper – September, 2022

This opens the possibility of specialisation across the value chain and streamlines the entire e-commerce experience. ONDC becomes the foundation of trust between all parties, leveraging their respective expertise in different areas.

INNOVATION AND COMPETITION IN E-COMMERCE

With regards to the platforms themselves, ONDC enables competition, lowering the barrier of entry for new e-commerce platforms. Any platform, which is part of ONDC will have the same visibility as industry incumbents regardless of size, thereby eliminating the “network effects” mentioned earlier which hamper competition. This will push innovation in e-commerce to offer consumers better services. The network also opens the door for specialized platforms to reach out to more niche markets. Such platforms have emerged in sectors as varied as waste (Recykal has launched Asia’s first Circular Economy Marketplace specializing in selling recycled waste products online), fashion (Meesho) and agriculture (BigHaat etc.). This promises to bring in more specialization in digital commerce and unlock additional value. ONDC’s potential is, therefore, not restricted merely to the retail sector and can help fulfil demand in underserved markets. In fact, the ONDC network looks to expand to wholesale, mobility, logistics, hospitality and travel, and urban services and will also cover business to business transactions.[1] With payment gateways also being a part of ONDC (Paytm is already on board), the open network will harness the strength of India’s digital public infrastructure to transform the way we view e-commerce, in the way that UPI has revolutionized payment systems.

POTENTIAL PITFALLS FOR ONDC As of December, 2022, ONDC has gone Beta live in 2 cities – Bengaluru, Karnataka and Meerut, Uttar Pradesh. The process of onboarding buyers, sellers and enablers is still underway, with some big names such as Microsoft and Paytm already a part of the network and Flipkart and Amazon considering joining.

However, a report by JM Financial Institutional Securities Limited[1] points out some of the pitfalls for ONDC truly democratising e-commerce. The report highlights that onboarding of enough participants is vital for success, particularly the larger players. Further, as currently buyers can set preferences of which seller platform search results to list, the MSMEs and smaller platforms that are listed will have to match the consumer experience offered by larger platforms in terms of delivery times, prices, and other aspects. Free data exchange is also essential for small sellers to benefit from the network. The roles and liabilities of all participants also need to be spelt out clearly and enforced to ensure better customer experience, especially in cases of refunds, cancellations, incorrect deliveries, quality of products etc. The typical Kirana store will have to become more efficient to fulfill rising demand from ONDC listed buyers, who have the option to switch back to the traditional players in e-commerce. ONDC also promises cheaper products, but initial reports from the restaurant sector in Bengaluru in the ONDC pilot suggest that final order value is at par or sometimes even higher than food delivery apps like Zomato. There are also some unanswered questions about the possibility of onboarding fees (it is currently free on ONDC), overall take rates and awareness about the onboarding process in Tier II and Tier III cities (the beta phase in Meerut will provide insights into the latter).

BUILDING DIGITAL PUBLIC INFRASTRUCTURE

Given that India has been at the forefront of digital technology and has been successful in building digital public infrastructure such as UPI, it is likely that several of the questions regarding ONDC will be answered during its pilot phase and will inform decisions about the final rollout. Leveraging e-commerce to boost economic activity and improve market access for the large informal sector will ensure that the benefits of India’s growing market size will accrue to bottom of the pyramid players.

Amitabh Kant India’s G20 Sherpa and former NITI Aayog CEO in an article titled ‘The Indian Innovation that can Change the World’ wrote –

“The ONDC network, has gone live by providing access and equity to small and medium sized merchants, increasing choice and quality for customers, and ensuring competitiveness and efficiency across the value chain. ONDC is significant given that the coverage of retailers using digital commerce has remained at 15,000 out of 120 million retailers, while the estimated size of online shoppers is projected to be about 220 million by 2025. ONDC will revolutionise how people transact and empower MSME’s and with greater negotiation options.”

ONDC has gone alpha live in 83 cities (apart from beta live tests in 2 cities) and has onboarded 800 merchants and 26 participants in four domains.[2] However, ONDC will truly become a digital public good only when the local Kirana shop becomes visible on every e-commerce platform and tap into the growing consumer base of Indian retail.

[1] “Open Network for Digital Commerce: Democratizing Digital Commerce in India” – ONDC Strategy Paper – January 2022 [2] Future of Consumption in Fast-Growth Consumer Markets: INDIA, World Economic Forum, January 2019 [3] “ONDC – Evolution or Disruption?” – JM Financial Institutional Securities Limited [4] “Open Network for Digital Commerce: Democratizing Digital Commerce in India” – ONDC Strategy Paper – January 2022 [5] “Open Network for Digital Commerce: Democratizing Digital Commerce in India” – ONDC Strategy Paper – January 2022 [6] “Building Trust in the ONDC Network” – ONDC Consultation Paper – September, 2022 [7] https://government.economictimes.indiatimes.com/news/digital-india/etgovernment-explained-what-is-open-network-digital-commerce-and-how-it-enables-msmes-to-sell-worldwide/90285553 [8] “ONDC – Evolution or Disruption?” – JM Financial Institutional Securities Limited [1] [9]https://government.economictimes.indiatimes.com/news/technology/ondc-set-for-a-bumper-2023-with-85-cities-800-merchants-and-26-participants-already-on-board-mdceo-t-koshy/96659864

Srishti Shanker is a policy communications professional and journalist with experience in TV, Print, Digital; ex-Network 18, DD News